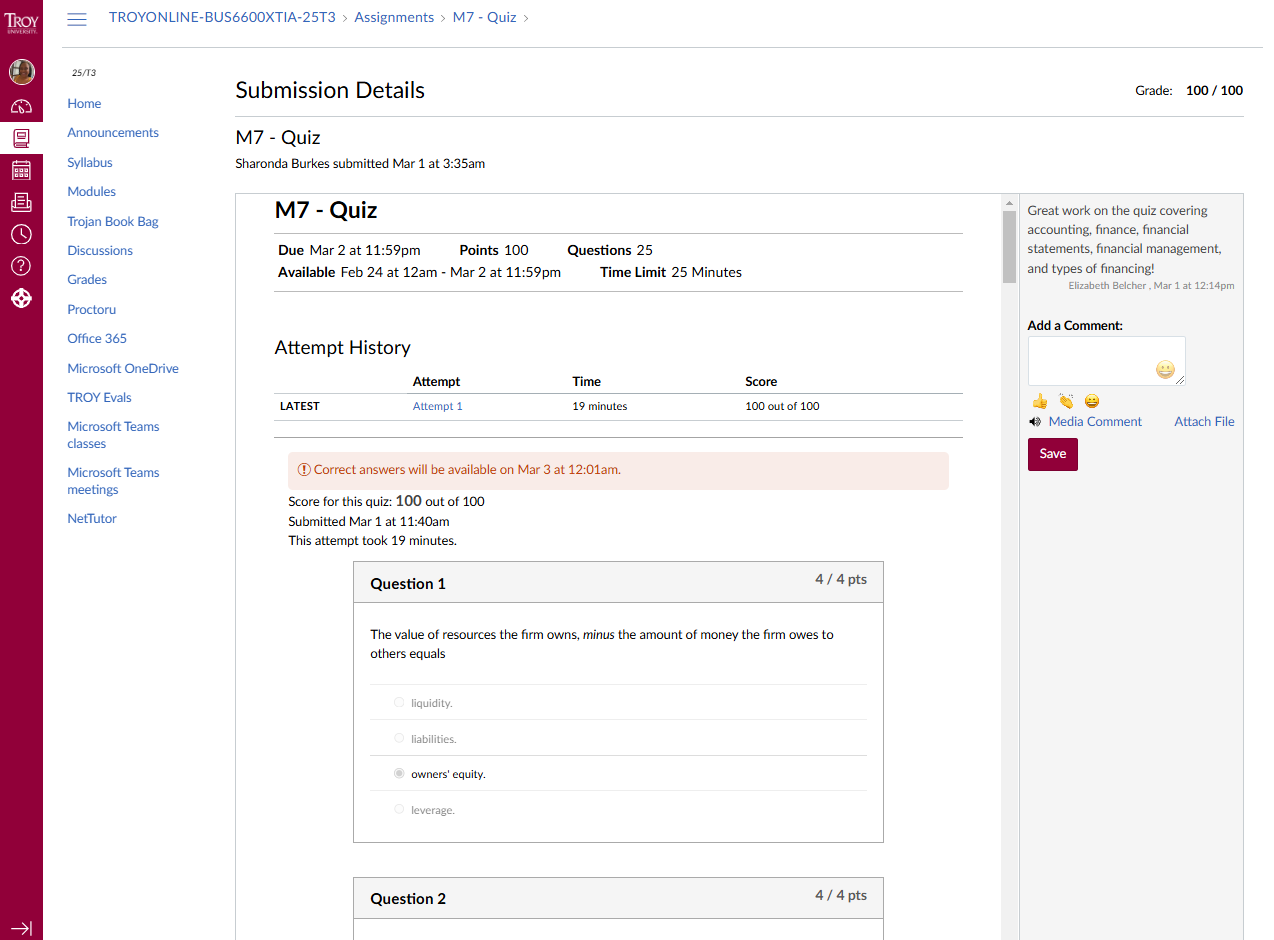

BUS6600: M7 - Quiz | Score for this quiz: 100 out of 100 | Submitted Mar 1 at 11:40am ...

BUS6600: Survey of Business Concepts

M7 - Quiz

Started: Mar 1 at 11:40am

Question 1 4 / 4 pts

The value of resources the firm owns, minus the amount of money the firm owes to others equals

- liquidity.

- liabilities.

- owners' equity.

- leverage.

Question 2 4 / 4 pts

__________ involves the review and evaluation of the records that are used to prepare the organization's financial statements.

- Certified bookkeeping

- Financial accounting

- Managerial accounting

- Auditing

Question 3 4 / 4 pts

The main reason an accountant would conduct a trial balance is to

- ensure the audit was done correctly.

- verify the validity of last year's balance sheet before beginning the next accounting cycle.

- determine whether account figures in the ledger are correct and balanced.

- obtain an estimate of the amount of taxes the firm owes.

Question 4 4 / 4 pts

When creating the income statement, which of the following statements is accurate?

- Revenues, minus Depreciation Expense = Gross Profit.

- Revenues, minus Cost of Goods Sold = Gross Profit.

- Revenues, minus General Operating Expenses = Gross Profit.

- Revenues, minus Tax Expense = Gross Profit.

Question 5 4 / 4 pts

__________ is the systematic write-off of the value of a tangible asset over its useful life.

- Gross margin allocation

- Depreciation

- Capital budgeting

- Liquidation

Question 6 4 / 4 pts

To effectively run a business, it is necessary to

- hire a full-time accountant.

- understand and use accounting information.

- use a public accounting firm.

- make certain that you do not spend too much time on your accounting system.

Question 7 4 / 4 pts

__________ is the monetary value that is received for goods sold, services rendered, and money received from other sources.

- Net income

- Gross margin

- Cost of goods sold

- Revenue

Question 8 4 / 4 pts

An important difference between accounting and other business functions, such as marketing and management, is that

accounting offers us insight into whether the business is financially sound.

accounting involves mainly clerical activities and thus requires very little analysis.

accounting deals exclusively with numbers.

accounting functions must be performed by an outsider, rather than by an employee of the business, in order to avoid conflicts of interest.

Question 9 4 / 4 pts

Generally, a high __________ ratio could lead investors and creditors to view the company as being very risky.

- diluted earnings per share

- inventory turnover

- debt to owners' equity

- acid-test

Question 10 4 / 4 pts

Retailers attempt to sell older merchandise before more recently acquired merchandise is sold. The assumptions made by the __________ method of inventory valuation are most consistent with this approach.

- average costing

- LIFO (last-in, first-out)

- accelerated costing

- FIFO (first-in, first-out)

Question 11 4 / 4 pts

Which financial statement reports the company's revenues and selling costs over a period of time?

- income statement

- trial balance

- statement of cash flows

- balance sheet

Question 12 4 / 4 pts

A __________ is a specialized accounting book, where transactions are categorized according to type. For example, all utility transactions are recorded in the same category.

- journal

- ledger

- balance sheet

- trial balance

Question 13 4 / 4 pts

Use the fundamental accounting equation to solve the following: Assets minus Liabilities equals

- Cash Reserves.

- Gross Margin.

- Owners' Equity.

- Net Income.

Question 14 4 / 4 pts

Which organization would be most likely to acquire short-term funding by issuing commercial paper?

- a small business that is unable to qualify for loans from commercial banks

- a company that prefers equity financing to obtain short-term funds

- a well-known, financially stable corporation

- a firm with a significant percentage of current assets held as accounts receivable

Question 15 4 / 4 pts

A __________ forecast predicts the revenues, costs, and expenses a firm will incur for a period of one year or less.

- short-term

- tactical

- near-horizon

- capital expenditures

Question 16 4 / 4 pts

A __________ forecast predicts the future cash inflows and outflows in future periods.

- money based

- long-term

- cash flow

- short-term

Question 17 4 / 4 pts

A loan backed by collateral represents a(n)

- pledging factor.

- secured loan.

- debenture bond.

- bond trust.

Question 18 4 / 4 pts

Through equity financing, stockholders become __________ of the firm.

- suppliers

- creditors

- owners

- employees

Question 19 4 / 4 pts

What is a primary area of concern for financial managers?

- poor advertising messages

- inadequate market control

- inability to recruit qualified workers

- undercapitalization

Question 20 4 / 4 pts

Typically, only highly regarded customers with financial stability receive

- trade credit.

- bank premiums.

- secured loans.

- unsecured loans.

Question 21 4 / 4 pts

In order to assist in revenue realization, a(n) __________ allocates resources throughout the firm.

- budget

- forecast

- income statement

- balance sheet

Question 22 4 / 4 pts

The budget that estimates a firm's projected cash inflows and outflows, as well as cash shortages or surpluses during a given time period, is called the __________ budget.

operating

capital

monetary

cash

Question 23 4 / 4 pts

The effective management of accounts receivable requires financial managers to

- provide prompt cash payments to suppliers.

- review the credit history of new customers.

- allow customers more time in paying their past due accounts.

- refuse bank-issued credit cards.

Question 24 4 / 4 pts

One of the challenges of effective financial management is

- ensuring the satisfaction of each of the stakeholder groups.

- providing the financial data in a timely manner for management consultants to improve decision making.

- working within the strict regulations of the Financial Accounting Standards Board (FASB).

- having sufficient cash on hand without compromising the firm's investment potential.

Question 25 4 / 4 pts

To reduce the time and expense of collecting their accounts receivable, some firms

- accept bank credit cards.

- extend credit to new customers.

- offer extended payment plans to existing customers.

- adopt a just-in-time inventory policy.